Micro Finance

Micro Finance can be referred to those credits, money transfers, insurance etc. that are been made available for the business owner who owns a small enterprise in the different developing parts of the country. It has been observed in India that those who don’t have an access to the business loan becomes the major recipients of this kind of microfinance. This has been found that the interest rate is quite higher in micro loan in comparison to the personal loan.

The four types of microfinance are as follows:

- Microloan

- Micro saving

- Microinsurance

- Micro Lap

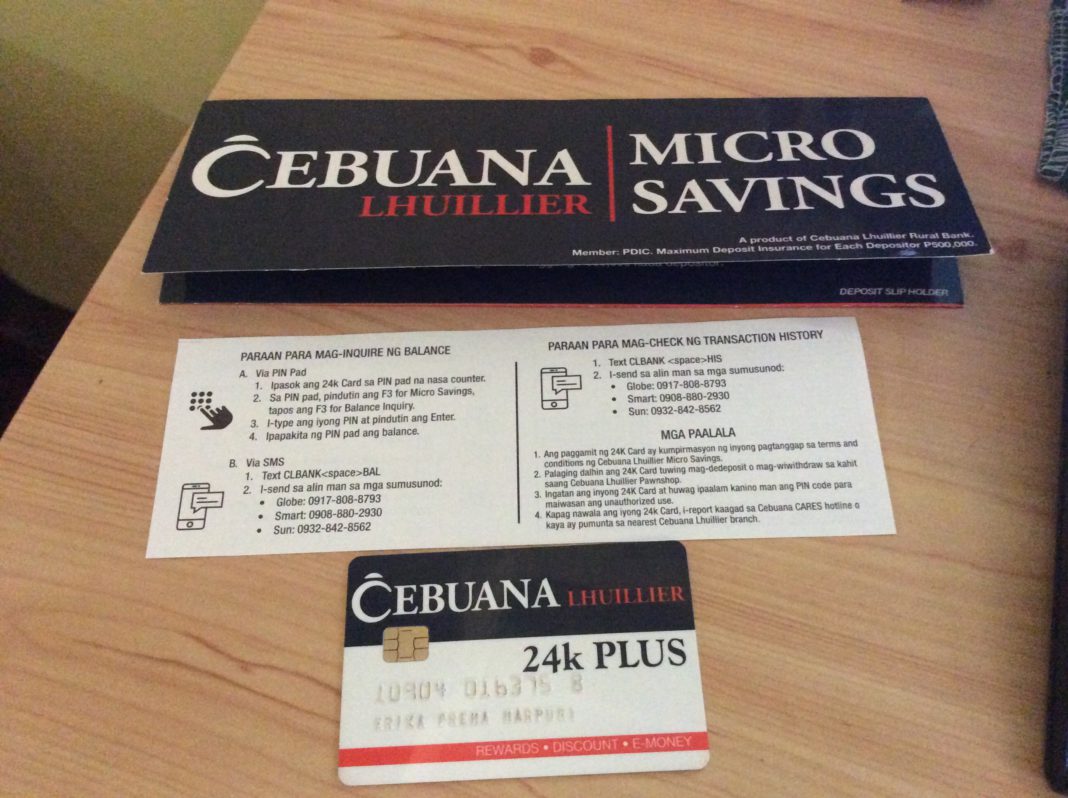

Micro savings: Micro savings are those savings account, which is made for the small businessman which allows them to operate this account with no minimal account balance. This makes the individual save money for the future and also makes them habituated to follow the financial disciplines.

Microinsurance: Those small businesses that take microloan gets a type of coverage which is known as Microinsurance. This kind of insurance has a lower minimum premium in comparison to that of the other traditional insurance plan.

Micro LAP: In India, it is been provided to the individual and the MSMEs at a higher rate of competition. The full form of Micro LAP is the loan against property. These kinds of loans can be secured upon the property an individual has and the tenure of this loan is near about 15 years.This loan can be used by the individual to finance their large expenses. Small business owners can take this loan in a larger amount and take a tenure of more than five years to avail this loan for meeting his small business expenses.

Microloan: The most important microfinance is referred to as microloan. This kind of loans is provided to the people who live in the underdeveloped parts of the country. They are provided with this kind of loan without any collateral. A microloan is important for an individual as it provides them with finance to set up small businesses and secure finance for their own livelihood. Whereas in comparison to the other traditional finance they provide a loan with much higher interest. This kind of loan provides a sense of financial stability which helps in the creation of financial assets and gives protection to any kind of financial risk. Here in India the importance and the urgency of microloan is very high as people of the underdeveloped region is high which led to the development of the various microloan app.

Entities Needed For Availing the Micro Loan

Microloans can be availed by people who are engaged in self-employment, small business owners, startups, women entrepreneur, unemployed people, workers with low wages and a lot more.

Purpose of Micro Loans

Microloans are used mainly for various activities related to business such as meeting the capital requirement of workers, managing the day to day expense, debt, the requirement of capital for maintaining the proper flow of goods etc. Sometimes people had to face a problem while availing the business loan generally considering microloans and microfinance.

The Objective of MicroLoan Providers In India

- It focuses on the promotion of socio-economic development of the people living in underdeveloped areas. It focuses on the unbanked population or the population who doesn’t hold any bank account.

- It helps to strengthen all the Self Help Group by providing them with the loan and making them work for the economic development of the country.

- It acts as a support and help in the promotion of the new startups and women entrepreneurship over the whole nation.

The Procedure of Applying For Micro Loan

- For availing of the microloan, individual needs to visit the official website of the MFI and fill up the application form and submit it along with the required documents

- Once the form is submitted the MFI representative will contact the individual and then carry forward the loan procedure.

- Once the MFI’s representative gets satisfied after getting all the documents the loan will be passed

Kiva India

India is a country having more than 32% of its population falling under the international poverty line and 68% of its population is been unable to fulfil basic needs and are in need of affordable capital sources. Keeping this need and opportunity in mind Kiva wanted to provide a community, which is globally leading i.e. a very simple way of supporting the areas of India that are basically isolated geographically and consist of the most vulnerable people, underserved groups.

This group includes people like widows, the disabled, and those individual who are basically not capable of supporting their own livelihood. Kiva foundation is active with three exciting field partnership that is client-centric and is community-based NGO that will ensure that Kiva loans reach to the needy first.

Some of the nonprofits organization are as follows:

- People’s forum: This is a nonprofit organization that operates in Odisha. Along with microloans the organization also provide some beneficial services like programs, which focuses on mental health, primary education and a lot more. People’s forum is distributing the Kiva funded loans to groups of people which consist of mainly widow women, disabled individual and many others.

- Mahashakti Foundation: This is a nonprofit organization, which is also based in Odisha. It focuses on providing business training, micro-credit for the purpose of development of the community, fair price medical services, support and protection to farmers and many more.

- WSDS: This is a well-established nonprofit organization in Manipur, a remote area of northeastern India. This organization mainly focuses on leading women above the age of 55 which is not usual for microfinance in India. It takes the initiative of distributing solar lamps among the villages of Manipur.

Kiva loans fall under the subject of Reserve Bank of India regulations that focus on the loan funds distributed among the Non-Government microfinance institution.

With the help of the Indian government, RBI has taken the initiative of helping the people of underdeveloped areas who even don’t have a bank account by reaching out to them and funding them.

The RBI has taken this initiative in partnership with various private limited companies and micro loan companies. The NGO act as the most common form of money lenders.