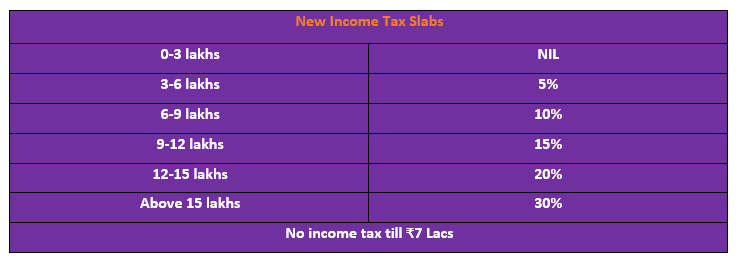

According to Finance Minister Nirmala Sitharaman; the government has changed the framework of the new income tax system in a significant way to benefit the middle class by making it more appealing to taxpayers. The optional tax regime, implemented in 2020–21, has been suggested for modifications in the Budget 2023–24.

On February 1, budget 2023 date, finance minister Nirmala Sitharaman delivered the final full-fledged Union Budget of the Modi administration before the 2024 Lok Sabha elections. The government sweetened the new income tax system by exempting up to 3 lakhs in income from income tax. People making up to Rs. 7 lakhs no longer have to pay income tax thanks to a rebate. The “default income tax system” was created by the FM, which also streamlined the tax code.

Updates on the Budget 2023

The income tax news bands have undergone numerous changes under the new tax structure, according to finance minister Nirmala Sitharaman. If all rebates are considered under the new tax code, a person will not be obligated to pay taxes on income up to Rs. 7 lakhs. At the post-Budget press conference, Sitharaman said that the government had made “significant changes” to its organisational structure that would help the middle class by improving the appeal of the new income tax system to taxpayers. She claimed that the country had been yearning for a straightforward, low-complexity direct tax system.

A person making Rs 9 lakh will only be required to pay Rs 45,000 in taxes under the new system. This only accounts for 5% of a taxpayer’s income under the new system. The standard deduction in the new tax code is Rs 52,500. The FM also said that the new tax structure would be the default.

The finance minister claimed that the new tax structure of the Indian budget now delivers more rebates, rendering it more desirable, in a media interview after the budget was unveiled.

New Income Tax Rates for 2023–24

Nirmala Sitharaman, the finance minister, in budget 2023 highlights introduced the Modi government’s final complete budget presentation by stating, “This is the Budget of Amrit Kaal’’. According to the FM, the world has acknowledged India’s economy as a positive sign. India currently has the greatest fiscal growth rate of all the major economies at 7%. In her budget speech, Sitharaman asserted that the Indian economy is moving in the right direction.

The average household income has increased to Rs 1.97 lakh. In her address introducing the Union Budget 2023, Sitharaman said that India’s economy had risen from 10th to 5th in the world over the previous nine years.

A slowdown and even a recession are plaguing the world’s major advanced economies simultaneously as the India Budget 2023 is unveiled. In light of this, the Economic Survey forecasts that India will continue to experience rapid economic growth, with its GDP expected to increase by 6.8% to 7.8% over the next year. According to the survey, budget 2023 date in India has fully recovered from the impact of the Covid-19 pandemic, which is encouraging for expectations for GDP development.

Indian Railways has a capital outlay of Rs 2.40 lakh crore for the first time. This is the greatest capital investment made by the railways, according to Sitharaman.

What Nirmala Sitaraman Stated about that?

The finance minister significantly increased capital expenditures. In the Union Budget, capital expenditures rose by 33% to Rs 10 lakh crore. 3.3% of GDP would be spent on it. The PM Awaas Yojana has also received a major boost, according to the FM.

In her Budget 2023 speech, Sitharaman emphasized the program’s extension for another year. She also launched a programme for primitive, underprivileged tribal tribes and announced plans for new agriculture businesses and fisheries. But Sitharaman is also in charge of upholding the 6.4 percent budget deficit target and presenting a clear intention to make it closer to the FRBM target in the upcoming years.

Also Read: It is All About Bajaj Finance Share Price in 2023